Ⅰ. Introduction

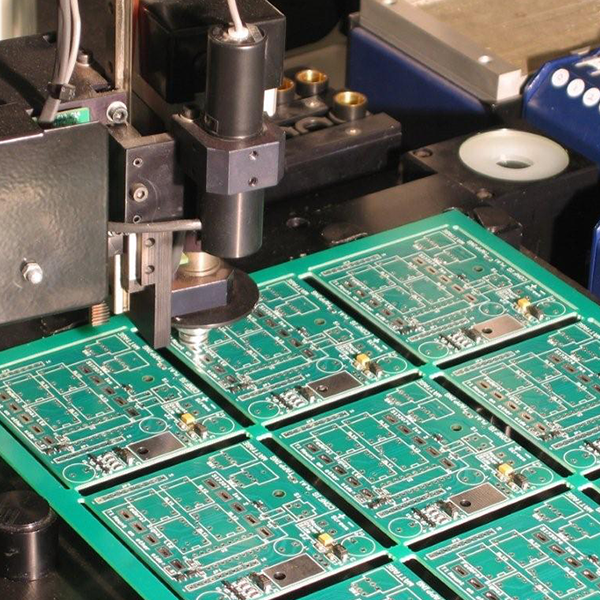

In today’s interconnected world, Printed Circuit Boards (PCBs) form the backbone of nearly every electronic device. From smartphones to satellites, PCBs are the unsung heroes that enable our modern technological marvels. As we enter 2024, the global PCB Manufacturer market continues to evolve, driven by emerging technologies and changing consumer demands.

The PCB industry, valued at $78.5 billion in 2023, is projected to reach $95.6 billion by 2026, growing at a CAGR of 4.8%. The increasing adoption of IoT devices, the rollout of 5G networks, and the rising demand for electric vehicles fuel this growth. As the industry expands, understanding the landscape of PCB Manufacturerrs becomes crucial for businesses and consumers alike.

Ⅱ. Ranking Methodology

Our ranking of the top 15 global PCB Manufacturerrs is based on a comprehensive analysis of multiple factors:

- Annual Revenue: A key indicator of market share and business scale.

- Technological Innovation: Assessed through patent filings and R&D investments.

- Production Capacity: Measured by annual output and facility size.

- Market Reputation: Based on customer reviews and industry awards.

- Global Presence: Evaluated by the number of manufacturing locations and served markets.

Data for this ranking has been collected from company financial reports, industry publications, and market research firms. The time frame is the fiscal year 2023 and the first two quarters of 2024.

Ⅲ. Top 15 Global PCB Manufacturer in 2024

1. ZD Tech (Taiwan)

Introduction

Zhen Ding Tech. Group includes Zhen Ding Technology Holding Limited which is Group’s first IPO company listed in TWSE(4958, Zhen Ding) in 2011, Avary Holding (Shenzhen) Co., Ltd listed in Shenzhen Stock Exchange (002938, Avary) in 2018, and Leading Interconnect Semiconductor Technology (Shenzhen) Co., Ltd. founded in Shenzhen 2019. Zhen Ding acquired BoardTek Electronics Corporation by share-swap in late 2020.Zhen Ding specializes in all types of printed circuit board (“PCB”), with early stage design-in, R&D, manufacturing and sales.

- Founded: 1999

- Specialization: High-density interconnect (HDI) PCBs

- 2023 Revenue: $4.2 billion

- Key Strength: Leader in smartphone PCB manufacturing

2. Unimicron (Taiwan)

Introduction

Unimicron Technology Corporation (Unimicron; TWSE: 3037) is a printed circuit board (PCB) manufacturer headquartered in Taiwan. The company produces PCBs, high density interconnection (HDI) boards, flexible PCBs, rigid flex PCBs, integrated circuit (IC) carriers, and others. In addition, it provides testing and burn-in services of IC substrates and PCBs. Applications of its products and services include liquid crystal display (LCD) monitors, personal computers (PCs) and peripheral products, notebook computers, network cards, facsimile machines, scanners, mobile phones, personal digital assistants (PDAs), and others. Unimicron has manufacturing sites and/or service centers in Taiwan, China, Germany, and Japan.

- Founded: 1990

- Specialization: Advanced IC substrates and HDI PCBs

- 2023 Revenue: $3.8 billion

- Key Strength: Cutting-edge technology in IC substrate production

3. DSBJ (China)

Introduction

Suzhou Dongshan Precision Manufacturing Co., Ltd. (hereinafter referred to as the company) was formerly a small sheet metal and stamping factory established in Dongshan Town of Suzhou in the 80’s. In April 2010, the company was successfully listed on the Shenzhen Stock Exchange (stock code 002384), with more than 60 wholly-owned, holding and shareholding enterprises.

- Founded: 1995

- Specialization: Flexible PCBs and rigid-flex boards

- 2023 Revenue: $3.5 billion

- Key Strength: Rapid expansion in automotive electronics

4. Nippon Mektron (Japan)

Introduction

Since its establishment in 1969, MEKTEC CORPORATION has been leading the global market as a pioneer in flexible printed circuit boards (FPC).

We have established manufacturing and sales sites all over the world and have moved forward together with our customers around the world under the global brand name “MEKTEC” since 1986.

MEKTEC contributes to the evolution of various electronic devices by providing products and technologies that realize miniaturization, weight reduction, and thinning.

- Founded: 1969

- Specialization: Flexible PCBs for mobile devices

- 2023 Revenue: $3.3 billion

- Key Strength: Pioneering ultra-thin, high-density flexible PCBs

5. TTM Technologies (USA)

Introduction

TTM Technologies, Inc. is a leading global manufacturer of technology solutions including mission systems, radio frequency (“RF”) components and RF microwave/microelectronic assemblies and quick-turn and technologically advanced printed circuit boards (“PCBs”).

- Founded: 1998

- Specialization: High-reliability PCBs for aerospace and defence

- 2023 Revenue: $3.1 billion

- Key Strength: Advanced PCB solutions for critical applications

6. Compaq (Taiwan)

Introduction

Established at Taoyuan Lu-Chu village in August 1973, Compeq Manufacturing Co., Ltd. was the first specialized printed-circuit board (PCB) manufacturing company in Taiwan to support the government’s policy in developing the high-tech industry. Beginning with producing single-sided and doubled-sided printed circuit boards, and progressing by persistent dedication to technology research and development, Compeq then started mass production of 6-layer printed circuit boards for computers in 1983, leading Taiwan PCB industry into the new stage for multi-layer board production.

- Founded: 1973

- Specialization: Multilayer PCBs and HDI boards

- 2023 Revenue: $2.9 billion

- Key Strength: Efficient mass production capabilities

7. Tripod (Taiwan)

Introduction

Jianding Technology Co., Ltd. is a Taiwanese company principally engaged in the manufacturing and selling of printed circuit boards. The company’s main products include double-sided and multi-sided printed circuit boards. The company’s products are mainly used to manufacture computers (PCs) and peripheral products, communication products, industrial instruments, consumer electronics and automotive products. The company operates primarily through two business segments: Printed Circuit Boards and Others. The company mainly sells products to domestic and foreign markets, including mainland China, South Korea, Malaysia and other countries.

- Founded: 1991

- Specialization: High-layer count PCBs

- 2023 Revenue: $2.7 billion

- Key Strength: Expertise in complex, high-layer PCBs for servers

8. Shennan Circuit (China)

Introduction

Shennan Circuits Co., Ltd. (hereinafter referred to as “SCC”), founded in 1984 , is headquartered in Shenzhen, Guangdong, China. Its main manufacture facilities are located in Shenzhen, Wuxi and Nantong, Jiangsu, China. Its business is all over the world, and there are subsidiaries in North America and R&D sites in Europe.

- Founded: 1984

- Specialization: PCBs for 5G infrastructure

- 2023 Revenue: $2.5 billion

- Key Strength: Leading supplier for 5G base station PCBs

9. IBIDEN(Japan)

Introduction

IBIDEN Group started business in 1912 as Ibigawa Electric Power Co., Ltd. with the mission of serving as the engine that would drive the local economy. Looking back our century-old history, we made persistent efforts on the study of our own technology and continued to challenge development of products, which met the needs of the age by banding together in any situation even though the changes in the environment surrounded our group.

- Founded: 1912

- Specialization: High-end IC substrates and motherboards

- 2023 Revenue: $2.4 billion

- Key Strength: Advanced packaging solutions for semiconductors

10. HannStar Board (Taiwan)

Introduction

HannStar Board specializes in the production of 2—to 26-ayer printed circuit boards (PCBs). Its products include PCBs designed for servers, network communications equipment, laptop computers, flat-screen TVs, game consoles, set-top boxes, industrial computers, and enterprise electronics. Production equipment consists of the most advanced machines and equipment sourced mainly from Europe, Japan, Taiwan, Israel, and the United States.

- Founded: 1998

- Specialization: PCBs for consumer electronics

- 2023 Revenue: $2.2 billion

- Key Strength: Cost-effective solutions for high-volume production

11. Samsung Electro-Mechanics (South Korea)

Introduction

Founded in 1973, Samsung Electro-Mechanics has grown into a world-class company that develops and produces major electronic components.

In our early days, we established the foundation for the self-reliant component industry in Korea through audio and video component production. In the 1980s, we expanded into materials and computer components, and our focus moved on to developing promising next-generation products, such as components for computer chips, mobile communication devices, and optical devices in the 1990s. Since the 2000s, we have been producing MLCC (Multilayer Ceramic Capacitors), power inductors, camera and communication modules, and substrates with world-class core technologies in materials, high-frequency wireless communication, and precision mechanics.

- Founded: 1973

- Specialization: High-density PCBs for mobile devices

- 2023 Revenue: $2.1 billion

- Key Strength: Vertical integration with Samsung’s electronics ecosystem

12. KBC PCB Group (China)

Introduction

The Kingboard Laminates Group established its first laminate manufacturing plant in 1988 in Shenzhen, the PRC, and began producing paper laminates in 1989. After that , our Group embarked on a path of rapid horizontal and vertical growth. Horizontally, the Kingboard Laminates Group expanded its production of new laminate products, including glass epoxy and flame retardant paper laminates. Vertically, the Kingboard Laminates Group expanded into the production of key upstream component materials, including copper foil, glass yarn, glass fabric, bleached kraft paper and epoxy resin. The copper foil operation based in Fogang, the PRC, was spun off for listing and listed on the SGX in 1999 under the name Kingboard Copper Foil. In December 2006, the Group successfully listed on the main board of The Stock Exchange of Hong Kong Limited.

- Founded: 1988

- Specialization: Diverse PCB portfolio

- 2023 Revenue: $2.0 billion

- Key Strength: Comprehensive PCB solutions across various industries

13. AT&S (Austria)

Introduction

Since AT&S was founded in 1987, we have grown to become a leading supplier of high-end PCBs and IC substrates. Our technologies appear in every area of modern life – from mobile telephones and computers to vehicles, industrial robotics, medical devices, aeroplanes and satellites. In addition, we make a crucial contribution to efficiency gains and energy savings.

- Founded: 1987

- Specialization: High-end PCBs and IC substrates

- 2023 Revenue: $1.9 billion

- Key Strength: Leading European PCB Manufacturerr with a global presence

14. Nanya PCB (Taiwan)

Introduction

Nan Ya PCB Corporation used to be one of the business divisions of Nan Ya Plastics Corporation which is part of Formosa Plastics Group and turned into a subsidiary by 1997 as the manufacturer of Printed Circuit Boards (PCBs) and IC Substrates.

On the back of the effort made for 50 years, Formosa Plastics Group held position number 323 on “Fortune 500” list in 2009.Therefore, Nan Ya PCB has always been following the guidance of “Diligence and simplicity”, “Get to the bottom of one thing”, “Keep one’s feet in the ground” and “Seek perfection” ruled by two founders of Formosa Plastics Group, Wang Yong-Ching and Wang Yong-Tsai, since then.

- Founded: 1985

- Specialization: High-layer count PCBs for computing

- 2023 Revenue: $1.8 billion

- Key Strength: Expertise in server and high-performance computing PCBs

15. Wus Group(Taiwan)

Introduction

WUS Printed Circuit (Kunshan) Co. Ltd. was established in Kunshan, Jiangsu Province in 1992, and got listed on the Shenzhen Stock Exchange’s SME Board in 2010 with stock code 002463 and stock abbreviation, Hudian Shares.

- Founded: 1972

- Specialization: Specialization: High-frequency and high-speed PCBs

- 2023 Revenue: $1.7 billion

- Key Strength: Advanced materials and designs for 5G and automotive applications

Ⅳ. Industry Analysis

Geographical Distribution

The global PCB Manufacturerr industry remains heavily concentrated in Asia, with Taiwan, China, and Japan leading the pack. These countries account for over 90% of global PCB production. However, there’s a growing trend of reshoring and nearshoring, particularly in North America and Europe, driven by supply chain concerns and geopolitical factors.

Technological Trends

- High-Density Interconnect (HDI): The demand for smaller, more powerful devices is driving the adoption of HDI technology.

- Flexible and Rigid-Flex PCBs are gaining popularity in wearables, medical devices, and automotive applications.

- 5G Infrastructure: The rollout of 5G networks creates significant demand for high-frequency PCBs.

- Advanced IC Substrates: As chip designs become more complex, the need for advanced IC substrates is increasing.

Market Drivers

- IoT Devices: The proliferation of IoT is fueling demand for PCBs across various sectors.

- Automotive Electronics: The shift towards electric and autonomous vehicles boost PCB demand in the automotive sector.

- 5G Technology: The ongoing 5G rollout drives high-frequency PCB production.

- Artificial Intelligence and Machine Learning: These technologies require advanced PCBs for data centres and edge computing devices.

Ⅴ. Critical Factors in Choosing a PCB Manufacturer

When working within a limited budget, choosing a PCB Manufacturerr that can meet your needs requires careful consideration of several key factors:

- Technological Capabilities: Look for Manufacturerrs with a track record of innovation and the ability to produce cutting-edge PCBs.

- Production Capacity: Ensure the Manufacturerr can meet your volume requirements and scale to meet your needs.

- Quality Control: Certifications like ISO 9001, AS9100, and IATF 16949 indicate robust quality management systems.

- Lead Times: Evaluate the Manufacturerr’s ability to meet your production schedules consistently.

- Design Support: A Manufacturerr offering design assistance can help optimize your PCB for performance and cost.

- Financial Stability: Choose Manufacturerrs with solid financial health to ensure long-term partnership reliability.

- Environmental Compliance: Look for Manufacturerrs adhering to RoHS, REACH, and other environmental standards.

Ⅵ. Future Outlook

The PCB Manufacturerr industry is poised for continued growth, with several key trends shaping its future:

- Miniaturization: The push for smaller, more powerful devices will drive advancements in HDI and microvia technology.

- Green PCBs: Environmentally friendly PCB materials and manufacturing processes will gain importance.

- Smart Manufacturing: Industry 4.0 technologies will enhance PCB production efficiency and quality.

- New Materials: Novel materials like liquid crystal polymers and polyimides will enable PCBs for extreme environments.

- Additive Manufacturing: 3D-printed electronics may complement traditional PCB manufacturing in specific applications.

Ⅶ. Conclusion

The global PCB manufacturing industry continues to evolve rapidly, driven by technological advancements and changing market demands. As we’ve seen from the rankings, Asian manufacturers dominate the market, but competition is intensifying globally. For businesses relying on PCBs, choosing the right manufacturer is crucial for success in this dynamic landscape. By considering technological capabilities, production capacity, and quality control, companies can forge partnerships to help them stay competitive in an increasingly digital world.

Although the largest PCB suppliers in the world have been introduced above, there are many other suppliers to choose from. The right supplier is the one that provides products of the quality you expect within your budget. At TriWin, we pride ourselves on delivering high-quality PCBs tailored to meet your specific needs. Our commitment to technological innovation, robust quality control, and customer-focused design support ensures that we can provide the perfect solution for your projects. We look forward to achieving perfect cooperation with your company and helping you stay ahead in the fast-paced electronics industry.

Ⅷ. Frequently Asked Questions (FAQ)

Q: What is the current size of the global PCB Manufacturer market?

A: As of 2023, the global PCB Manufacturer market was valued at $78.5 billion and is projected to reach $95.6 billion by 2026.

Q: Which country is the largest producer of PCBs?

A: China is currently the largest producer of PCBs, followed by Taiwan and Japan.

Q: What are the fastest-growing segments in the PCB Manufacturer industry?

A: The fastest-growing segments are flexible PCBs, HDI boards, and IC substrates, driven by demand in smartphones, wearables, and advanced computing applications.

Q: How is the PCB Manufacturer industry addressing environmental concerns?

A: Many PCB Manufacturerrs are adopting green manufacturing processes, using lead-free materials, and implementing recycling programs to address environmental concerns.

Q: What impact is5G having on the PCB Manufacturer industry?

A: 5G drives demand for high-frequency PCBs and creates new opportunities for PCB Manufacturerrs in infrastructure and device markets.